TransUnion | Products

CreditVision 4 Business (CV4B)

Providing traditional credit providers with an automated risk assessment tool within the business segment.

TransUnion CreditVision 4 Business

Know whether debtors can and will meet their credit obligations, before liquidation is even on the cards

Lenders face continued economic pressures and widespread competition in the trade credit industry. The proactive and efficient management of credit risk — before the liquidation of business customers is on the cards— is therefore critical to success for lenders.

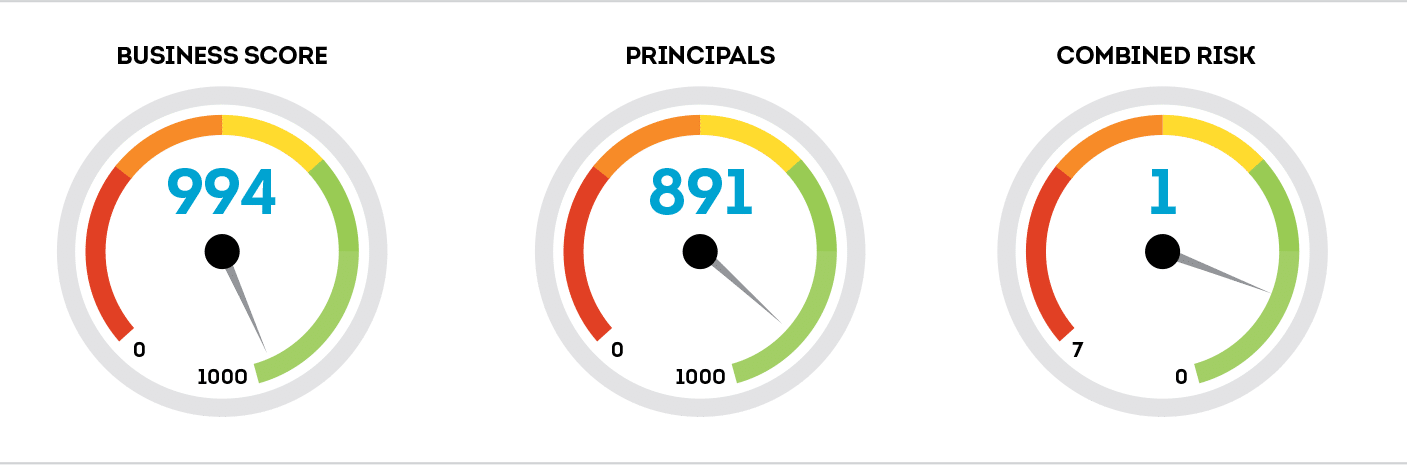

CV4B determines the likelihood of a business defaulting on a credit facility within 12 months. Based on TransUnion’s extensive commercial database, the scorecard suite uses over 200 predictive characteristics to determine this probability. CV4B helps lenders harness the power of alternative data sources and a multidimensional evaluation of risk to gain insight into how likely a business is to repay its debt.

Product Highlights

Eliminate manual reviews and improve your portfolio risk management

Keep credit risk exposure within acceptable parameters

Offer the right price and terms to customers, based on risk levels

Enhance customer segmentation and targeted campaigns

Customer Acquisitions

Debtor Management and Recovery

Easy to understand output